December 8th, 2014

VOICE OF DOLLARS

FINANCIAL NEWS

Japan

The numbers are out for Japan’s recession and it is deeper than was previously estimated. Japan’s economy shrank by 1.9% in annual terms from July to September, well above the forecasted 1.6%. It shrank 0.5% on a quarterly basis. A fall in business spending plunged the economy into a deeper recession. Japan is the world’s 3rd largest economy, it shrank 7.4% in the Q2. The increase in sales tax from 5% to 8% had hit growth. The dire data forced the PM to seek a mandate to delay an increase in the tax to 10% scheduled for 2015. The tax was legislated to deal with Japan’s huge public debt, highest among developed nations.

Australia

The Australian dollar has fallen to a four-and-a-half year low trading at 82.96 US cents, down from 83.76 cents on Friday. This is in part due to strong US employment growth figures. Other currencies are under pressure at the end of last week. The biggest losers were the Japanese yen, the NZ dollar and the Australian dollar.

United States in 2015

The NABE (National Association for Business Economics) expect the overall economy as measured in gross domestic product to expend 3.1% in 2015 in the US. This would be the strongest GDP growth since 2005, when the economy grew 3.3%. The 2007-2009 recession was the worst depression since the 1930s. The US has been stuck with a sub-par growth averaging 2.2% per year. The NABE is composed of 48 economists believe job gains will boost consumer spending linked to the recent drop in energy prices. Consumer spending accounts for about 70% of economic activity.

A majority of the NABE panelists, believe the world’s developed economies are mired in a “secular stagnation”, a prolonged period of sub-trend growth. 2015 could be the year where Europe and Japan continue their downward trend. China’s growth is estimated to be 7% next year.

Europe

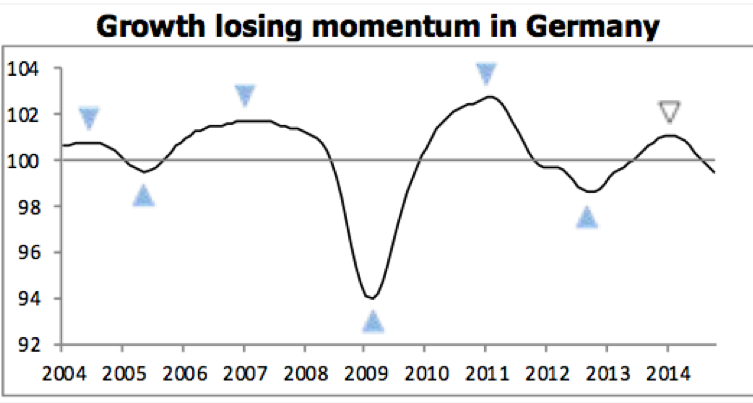

Some experts believe Eurozone economy is seeing a massive weakening with a contributing downturn in Germany. There is a high chance interest rates Q1 of 2015 will be lower. The European Central Bank (ECB) is under pressure to step up its stimulus campaign.

The Eurozone’s 13.2 trillion economy, is the world’s 2nd largest after the U.S. Unemployment rate is 11.5%. In France it is 10.5% more than twice that of Germany. In Spain the unemployment rate is 24% more than double that of the Eurozone at large. Italy’s 13.2% jobless rate was its highest since 1977. Retail sales there fell in September for a fifth-straight month.

Russia

Russia’s controversial relations with Europe and the US of late is substantially affecting Russia’s population of 144 million. A bad economy caused by sanctions means an austery lifestyle for Russians and a decrease in wages. Political discontent could be in the works for Russia in the period of 2015-2020. Estimates by experts point to the fact that Putin could exhaust more than half of the nation’s $420 billion of reserves, down from almost $600 billion in 2008, within the next two years.

The “social contact” in place in Russia, whereby the population understood that living standards will continue to improve, even at the expense of political freedoms, is now in jeopardy. Putin’s boom years include between 1999 and 2007, where Russia went through a rejuvenation in living standards that rose from Indian to Polish levels. The latest economic hardship, may turns things on their head and it’s entirely possible that Putin could be ousted in the foreseeable future. Through something more drastic would have to occur, since Putin’s personal approval ratings remain very high. Government approval ratings have fallen by 7% points in the past two months to 59%. Four-fifths of the population say living standards are “clearly worsening”.

Consumers are being squeezed by the 40% plunge in the ruble this year. Oil needs to go up from current $68 per barrel up to $90 for the 2015 budget to balance. This combined with sanctions imposed by the US and its allies to punish Putin for his Ukraine policy and annexing the Crimea peninsula in March, 2014. Inflation may mean a 10% increase in prices by the Q2.

VOICE OF DOLLARS

FINANCIAL NEWS

This feature is a thread on the Blog that discusses financial news.